Interact Analysis Examines Market Outlook for Gearboxes and Geared Motors

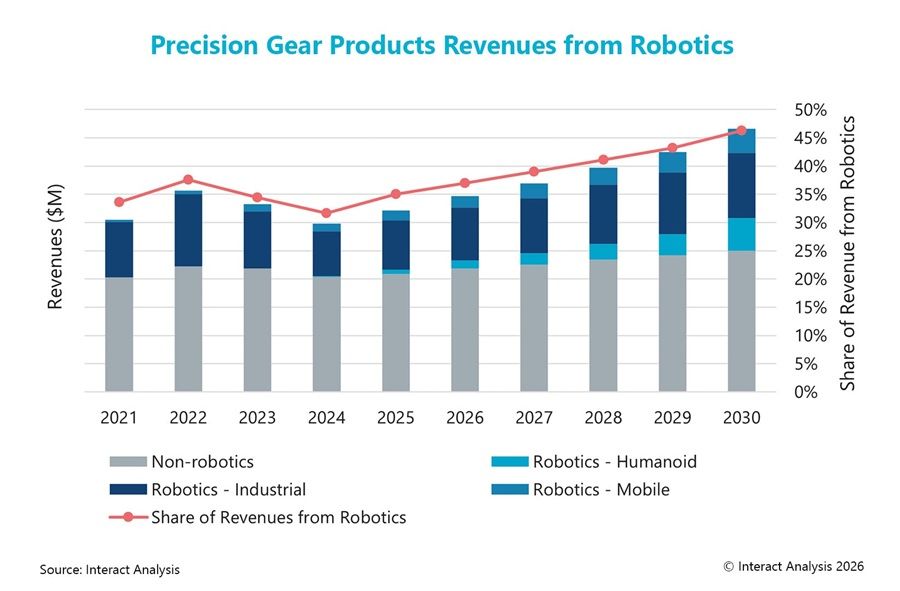

The precision gears market is closely linked to the robotics sector, which contributed 35 percent of global market revenue in 2025, up from 33.6 percent in 2021. By 2030, robotics is projected to account for 46.3 percent of the global precision gear products market. Our latest analysis shows sales of precision gear products across industrial robots, mobile robots, and humanoid robots, and indicates the share of revenues from robotics will increase steadily over the coming years.

Revenues from the industrial robots (including collaborative robots) sector accounted for 27.3 percent of global precision gearbox and geared motor sales in 2025, valued at $878 million. This marks a rebound from $790 million in 2024, although it still falls short of the $1.0 billion recorded in 2023. In 2024, the market contracted significantly, with industrial robot production dropping from over 521,000 units to just over 502,000 units.

The decline for robotics in 2024 was largely due to excess inventories from 2023 and weak investment across major regions. However, in 2025, industrial robot production recovered strongly in Asia, with precision gear product sales growing by 16 percent, while the market remained largely flat in the Americas and EMEA.

Stronger demand from the industrial robot sector is expected across all major regions in 2026. In the US, reshoring and recovering manufacturing production are driving robotics demand. In Europe, some delayed projects in the automotive sector are expected to resume, while in Asia, steady growth in the electronics and semiconductor industries, fueled by the AI boom, is contributing to a recovery.

Mobile robots – continued growth forecast

The mobile robot sector remains a high-growth and attractive industry, although our shipment forecast has been revised downward for this sector due to economic challenges. Tariffs and uncertainty in 2025 are delaying large-scale investments, prompting a shift toward phased rollouts for deployments.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.