Robot Orders Accelerate in Q3 as Automation Becomes a Strategic Imperative

North American robot orders climbed in the third quarter of 2025, signaling renewed momentum in manufacturing automation. According to the latest data released by the Association for Advancing Automation (A3), 8,806 robots valued at $574 million were ordered in Q3, an 11.6 percent increase in units and 17.2 percent rise in revenue compared to the same period last year.

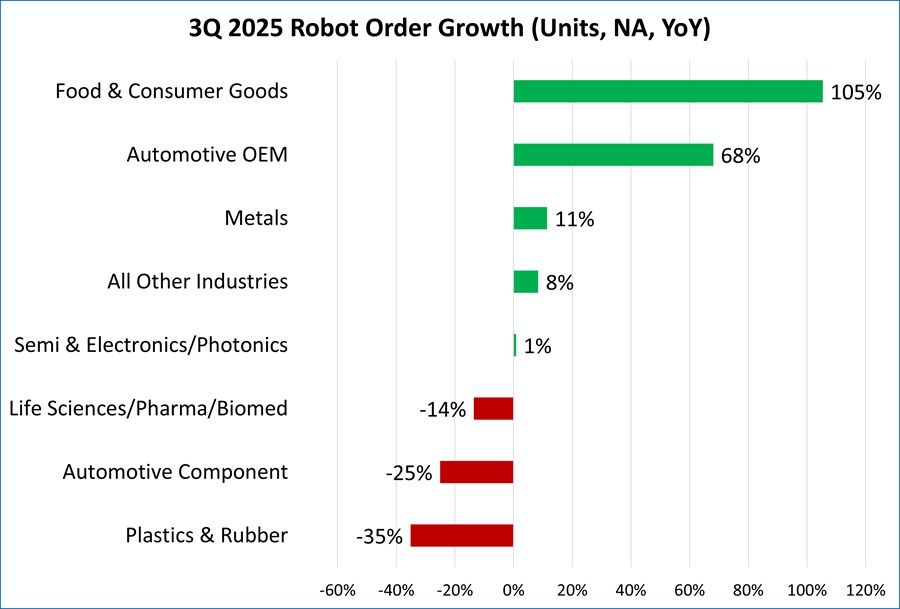

Automotive OEMs and Consumer Goods Drive Quarterly Gains

Key growth sectors in Q3 included food and consumer goods, which jumped 105 percent year-over-year, and automotive OEMs, which rose 68 percent. Additional gains came from metals (+11 percent) and all other industries (+8 percent), contributing to broad-based improvement across the quarter. In contrast, automotive component orders declined 25 percent, and plastics and rubber fell 35 percent, reflecting sector specific capital slowdowns.

Collaborative Robots Expand Market Presence

A3 began officially reporting collaborative robot volumes earlier this year. In Q3 2025, companies ordered 1,174 collaborative robots valued at $42 million, accounting for 13.3 percent of total units and 7.2 percent of total revenue.

Across the first nine months of 2025, collaborative robot orders reached 4,259 units valued at $156 million, representing 16.1 percent of units and 9.4 percent of total revenue. A3 plans to expand future reporting on collaborative robots to include growth rates and sector-specific trends.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.