Global Industrial Outlook: Oil Slick Cascading Through Sector

Global Industrial Outlook: Oil Slick Cascading Through Sector

Brian Langenberg

Third-quarter earnings are confirming the worst-case scenario, i.e. — not only are energy- related end markets in a downturn, but conditions continue to worsen.

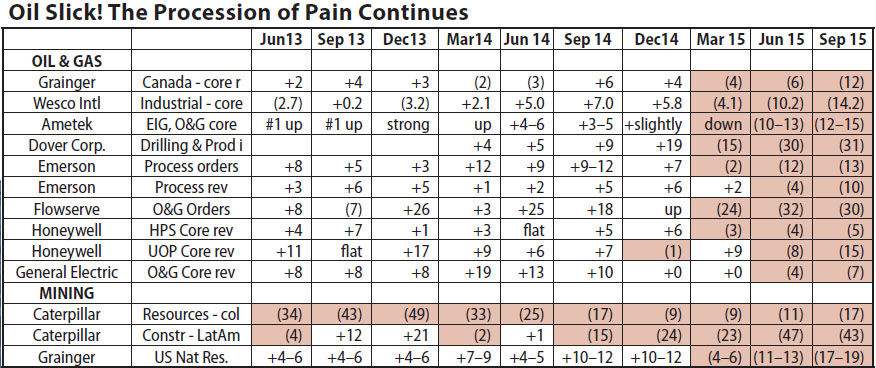

Maintenance, repair and overhaul (MRO) is holding up relatively well (which actually means down less), but upstream activity is getting killed. Two companies with “big project” oil and gas exposure are citing bad pricing with Emerson stated, “worse we’ve seen in years,” and Flowserve confirming, “down 5-10%,” on large projects. Here are energy-specific results for selected companies, quarter-to-date:

Canada will offer no respite. Not only will low oil prices (and the associated strong dollar) continue to weigh on energy and exports, but I also think you can kiss the Keystone Pipeline goodbye — even after 2017. New Canadian Prime Minister Justin Trudeau has voiced some support for Keystone XL, likely meant to garner electoral support out of Alberta; but his heart is with the “climate change” crowd and repairing Canadian relations with Obama. His life story and track record do not scream “drill baby drill.”

Partial off-sets are on the horizon beyond 2016 from non-residential construction, improving home prices and municipal budgets. Caterpillar voiced optimism about a highway bill before year end which, now that we have a speaker, is possible. However, it is more of an extension of current activity and hardly a “rebuild the country” move.

Machinery outlook for ’16 is negative. Aside from truck (replacement mostly), expect continued negative comparisons from oil and gas, mining, agriculture, and power generation.